Supply Chain Woes Reach Manufacturing Industry

Manufacturing is a pretty straightforward business model: make things and then sell them. It works well if supply chains are operating as expected. Supply chain disruption, though, has become so prevalent that everything has become extremely complicated for OEMs. Getting manufacturing equipment is challenging, getting parts is hard, and getting products to customers is fraught with complexity.

Consider the list of unprecedented woes that occurred in recent months: pandemic lockdowns, blocked shipping lanes, container scarcity, material and component shortages, extreme weather events, rising prices, military conflicts, and more. All this on top of normal challenges, from end-of-life components to business shifts. For all concerned, the boom in demand for products containing electronic components has been both a blessing and a challenge (one-year lead times sounding familiar?).

Disruption becomes the norm

In some ways, that’s good news: everyone is in the same boat. I recently read a survey conducted by the Manufacturing Leadership Council that put into numbers some of the things that I’ve been hearing about. For example, when asked about supply chain disruption, nearly every manufacturer reported some level of disruption.1 More than half (52.5 percent) of manufacturers surveyed said that their supply chain had experienced “significant disruption” in the past two years. Further, manufacturers are resigned to the disruption being a long-term problem, with more than a third predicting another year of chaos and 14 percent believing that turmoil will be the norm for two years or longer.

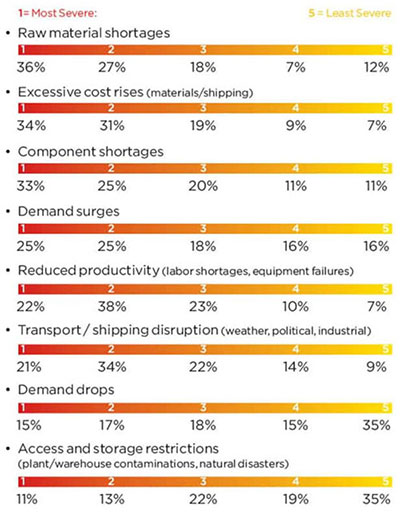

Figure 1: Raw materials shortage is top of mind for manufacturers, but the list of challenges is long and included materials, cost, and demand issues. (Image source: Manufacturing Leadership Council, 2022)

Figure 1: Raw materials shortage is top of mind for manufacturers, but the list of challenges is long and included materials, cost, and demand issues. (Image source: Manufacturing Leadership Council, 2022)

Manufacturing equipment destined for slow growth

At a global level, these challenges are hindering growth of the manufacturing industry. Global manufacturing growth is expected to hover at under four percent in 2022, according to analysts at Interact Analysis. Europe will be hit hardest with a growth of 3.7 percent, compared to seven percent in 2021. On a bright note, the semiconductor and electronics machinery sectors are likely to enjoy better growth rates than just about any other. The optimism needs to be tempered since analysts think that the historical boom/bust cycle of the semiconductor industry is unlikely to make that level of growth sustainable over the long term.

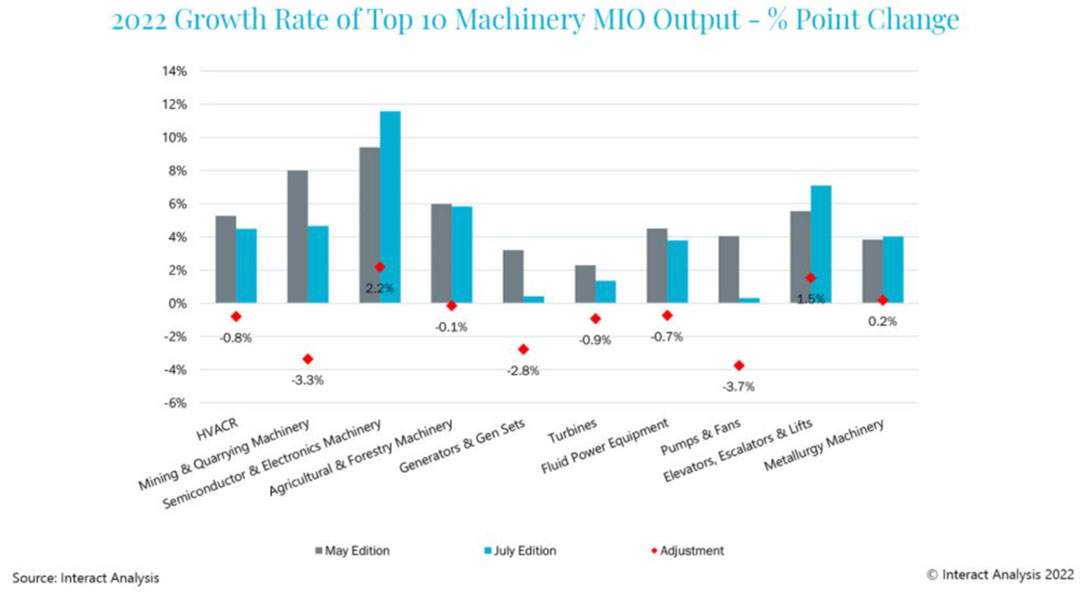

Figure 2: Seven of the top ten sectors for manufacturing machinery will experience negative growth. Semiconductor and electronics machinery, though, will enjoy modest growth of 2.2 percent between May and July and overall growth of 6.2 percent this year. (Image source: Counterpoint Technology Market Research)

Figure 2: Seven of the top ten sectors for manufacturing machinery will experience negative growth. Semiconductor and electronics machinery, though, will enjoy modest growth of 2.2 percent between May and July and overall growth of 6.2 percent this year. (Image source: Counterpoint Technology Market Research)

World events, and especially inflation, are behind the less-than-robust market. “In particular, inflation has caused severe problems by increasing input costs for energy, raw materials, and components,” said Tim Dawson, senior research director at Interact Analysis.2 “In the US, a strong dollar is damaging the competitiveness of manufacturing exporters. Meanwhile, China is far less badly impacted by inflation, with a rate of just under 3 percent (compared to 9 percent in the US).”

US pushes for manufacturing growth

The United States CHIPS Act, which promises a $52 billion investment in semiconductor manufacturing, is one positive change that may push growth domestically. The White House reports that its policies have added 642,000 manufacturing jobs to the American market since 2021.3 Further construction of new manufacturing facilities is also rising substantially (116 percent this year over last year)—a promising sign, but not a quick fix for the market.

Several large manufacturers have announced intentions to increase chip manufacturing capacity. Micron, for example, is investing $40 billion into making memory chips, while Qualcomm and GlobalFoundries have announced a partnership that puts $4.2 billion into expanding GlobalFoundries’ manufacturing facility in upstate New York, and increasing Qualcomm’s semiconductor capacity up to fifty percent over the next five years.

The challenges of today’s manufacturing landscape have taken center stage of late. The headaches are real. At the same time, the electronics industry is faring better than many sectors. There are many positive signs on the horizon that the electronics industry, and especially the domestic market, will evolve in positive ways. The United States clearly hung on to leadership in the innovation and design arena, and it looks like electronics manufacturing is also on track to produce positive results domestically.

References:

2: https://www.interactanalysis.com/global-manufacturing-output-growth-reaches-3-9-for-2022/

Have questions or comments? Continue the conversation on TechForum, DigiKey's online community and technical resource.

Visit TechForum