Will the Infrastructure Bill Help the Supply Chain?

For much of the summer, there was excitement about proposed sweeping legislation on two fronts—the $1.2 trillion bipartisan infrastructure bill spanning the next five years and a similarly bipartisan legislative plan to boost the competitiveness of the United States in the semiconductor industry. For electronics manufacturers and distributors, both of these initiatives are important—but one has gone forward while the other is stalled mid-process.

The infrastructure side

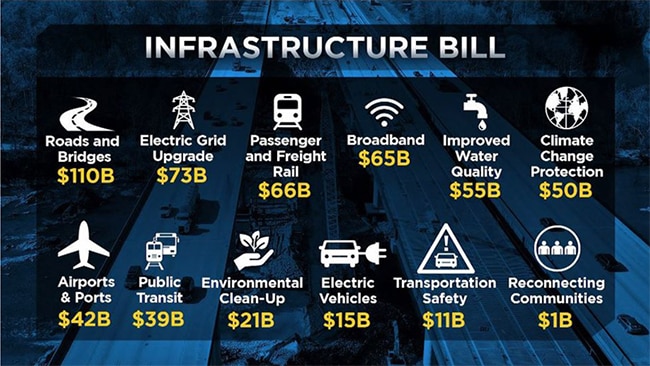

As the year closes, the Infrastructure Investment and Jobs Act is moving forward to improve roads, bridges, ports, airports, and automobile and transit systems,1 while legislation for the semiconductor industry hasn’t budged. For manufacturers struggling to get materials to factories, parts from vendors and partners, and finished products to customers, there is no argument that there is a gap between the infrastructure we have and the infrastructure we need. The new legislation promises a lot of improvement that will help manufacturers directly or indirectly, whether they are getting products via rail, road, or sea. Here are the highlights:

- $110 billion for roads, bridges, and major transportation projects

- $66 billion for passenger rail

- $11 billion for safety for the National Highway Traffic Safety Administration, Federal Motor Carrier Safety Administration, Pipeline and Hazardous Material Safety Administration, and a “Safe Streets for All” program

- $39 billion for transit, including for Capital Investment Grants and the “low-no” emission vehicle procurement program

- $25 billion for airports

- $17.3 billion for ports and waterways

- $46 billion for infrastructure resiliency investments

- $7.5 billion for low-carbon and zero-emission school buses and ferries along with another $7.5 billion for electric vehicles and low-carbon school buses and ferries

- $65 billion for broadband

- $55 billion for water infrastructure

- $73 billion for power and electric grid infrastructure investment.

Figure 1: As passed, the infrastructure bill is set to improve highways, bridges, ports, rail, the power grid, broadband Internet, and more. It may well alleviate some big supply chain headaches for manufacturers. (Image source: CNN)

Figure 1: As passed, the infrastructure bill is set to improve highways, bridges, ports, rail, the power grid, broadband Internet, and more. It may well alleviate some big supply chain headaches for manufacturers. (Image source: CNN)

The new bill calls for the creation of an Office of Multimodal Freight Infrastructure and Policy within the Department of Transportation and adds $100 billion in discretionary funding that may be used to improve the movement of goods. That entity will manage grant programs and will also be tasked with helping federal, state, and local governments create freight policies that encourage supply chain efficiencies. At a ground level, it also calls for the creation of a commercial trucking apprenticeship program starting as early as this January.

What about semiconductors?

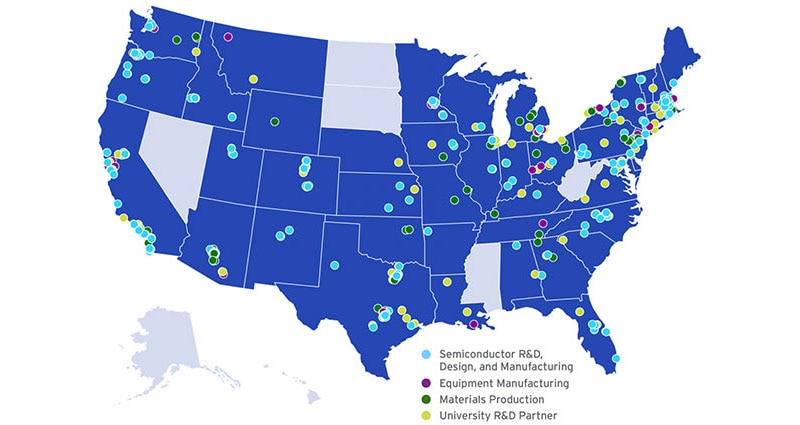

At the same time, semiconductor manufacturing is an equally large drag on the system. Today, the fact that only 12 % of chips (a figure quoted by a variety of sources2) sold globally are made in the United States remains problematic—both in terms of sourcing necessary components and building robust domestic technology businesses. In 1990, that figure was 37 %, a sharp decline. In other parts of the world, governments have offered compelling incentives to manufacturers to bring their manufacturing to their geographic location.

Figure 2: The U.S. government has an opportunity to fight against the trend of the nation’s declining involvement in the global semiconductor industry. Robust incentive programs will be an important step in that direction. (Image source: Semiconductor Industry Association & Boston Consulting Group)

Figure 2: The U.S. government has an opportunity to fight against the trend of the nation’s declining involvement in the global semiconductor industry. Robust incentive programs will be an important step in that direction. (Image source: Semiconductor Industry Association & Boston Consulting Group)

In June, the Senate passed the bipartisan United States Innovation and Competition Act (USICA)[1] to promote the leadership of the United States in science and technology. It includes $54 billion in federal investment in the domestic semiconductor research, design and manufacturing put forward in the CHIPS for America Act. However, the House of Representatives has not yet joined in supporting the legislation, so it languishes.

This may in part be linked to general agreement on the issue (we need chips), but less clarity around how to get there (some fear that hardline measures toward China could actually make things worse by shutting off trade).

The far-reaching and tumultuous discussions around what United States manufacturing needs have no simple answers. However, every business and consumer has become aware of the importance of having a conversation. No one bill or legislative attempt is going to fix every problem—but clearly, supply chain and chip technology are two important avenues of progress.

References:

Have questions or comments? Continue the conversation on TechForum, DigiKey's online community and technical resource.

Visit TechForum