U.S. Semiconductor Scene Set to Boom

Semiconductor manufacturing is a hard business—at least, in part, because it’s nearly impossible to match buying cycles and building cycles. Fabs take several years and often billions of dollars to plan and build, and demand for chips from certain sectors changes from quarter to quarter or even more quickly. Right now, especially in the United States, fab capacity is on the rise even as chip demand softens.

In April, Gartner projected that global semiconductor revenues will drop 11.2 percent in 2023, for total sales of $532.2 billion.1 Last year, the market totaled $599.6 billion in sales, a growth rate of only 0.2 percent compared to the year before. Analysts point out that DRAM demand is in major decline and that NAND will follow a similar pattern. Various markets are also growing at different rates, with high-volume sectors like PCs, tablets, and smartphones slowing, while automotive, industrial, the Internet of Things (IoT), and aerospace markets are on the rise.

However, these slowdowns are likely to be short-lived, and the question of product mix will be important as chip makers move toward supplying the leading-edge products required in strong growth markets (Figure 1).

![]() Figure 1 : Historically, sales growth for semiconductors has been strong, as much as 20 percent in 2021. Going forward, sales will still grow, but at a slower average rate of about six to eight percent annually through 2030. (Image source: McKinsey & Company)<sup2<></sup2<>

Figure 1 : Historically, sales growth for semiconductors has been strong, as much as 20 percent in 2021. Going forward, sales will still grow, but at a slower average rate of about six to eight percent annually through 2030. (Image source: McKinsey & Company)<sup2<></sup2<>

Meanwhile, semiconductor manufacturing equipment will likely see comparable ups and downs. Global fab equipment spending for front-end facilities is expected to decrease by 22% year-over-year (YoY) to $76 billion in 2023, from a record high of $98 billion, according to SEMI’s World Fab Forecast.3 In 2024, that figure is expected to rise 21 percent YoY to $92 billion in 2024.

![]() Figure 2 : Although spending on fab equipment slowed in 2023, those figures will continue to rise in order to support the strong growth in semiconductor fabs. (Image source: SEMI)

Figure 2 : Although spending on fab equipment slowed in 2023, those figures will continue to rise in order to support the strong growth in semiconductor fabs. (Image source: SEMI)

The 2023 decline stemmed from weakening chip demand and a higher inventory of consumer and mobile devices. Meanwhile, strengthening demand for semiconductors in the high-performance computing (HPC) and automotive segments will drive upcoming growth.

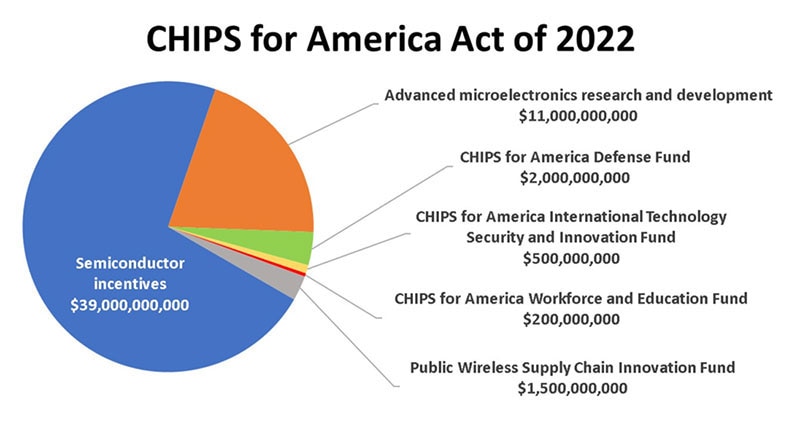

Building for the future, at home

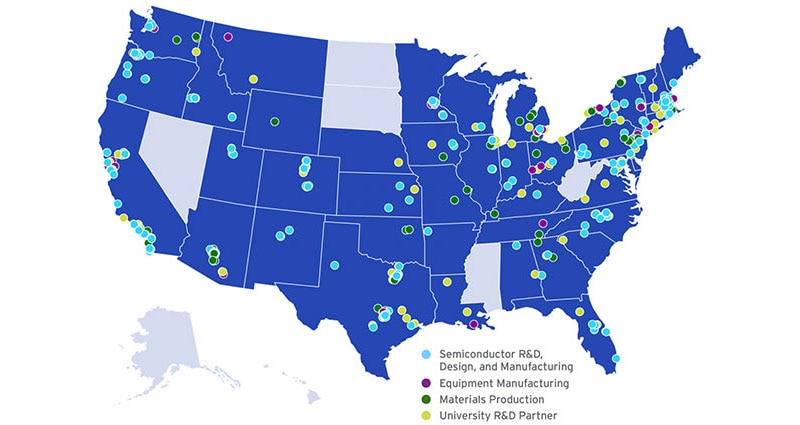

At the same time as these market dynamics are playing out, techno nationalism is gaining strength with an increasing number of organizations preferring to buy devices built at home. “Semiconductors today are seen as a national security issue,” said Richard Gordon, practice vice president at Gartner. “Governments around the world are scrambling to build self-sufficiency in the semiconductor and electronics supply chain. This is leading the incentivization of on-shoring initiatives across the world.”

In the next two to three years, semiconductor makers will be investing billions in the United States, creating tens of thousands of jobs. In the past year alone, a number of these companies announced plans to build chips in the United States, including:

- GlobalFoundries (GF) in June 2020 acquired 66 acres of land adjacent to its Malta, NY, Fab 8 facility,4 and then bought another 800 acres in April 2023,5 bringing its total holdings to 1,110 acres. GF employs approximately 2,500 people at the facility in which it has invested more than $15 billion to date.

- Intel announced early in 2022 that it would invest $20 billion in the construction of two new leading-edge chip factories in Licking County, Ohio, which will employ 3,000 people.6 The fab is expected to start delivering chips in 2025.

- Samsung Semiconductor broke ground in 2022 on a site in Taylor, Texas, with an eye toward a fab being operational in 2024.7 Samsung estimates that it will invest $17 billion in buildout, including $6 billion in buildings and $11 billion for machinery and equipment. The site will support 20,000 jobs.

- Taiwan Semiconductor Manufacturing Co. (TSMC) in late 2022 announced that it is expanding its Arizona fab with a $40 billion investment.8 By 2026, that fab will produce advanced chips using a 3 nanometer (nm) process node.

- Texas Instruments (TI) expects that in the end, it will have invested $30 billion and will have created 3,000 jobs with its 300 millimeter (mm) semiconductor wafer plant in Sherman, Texas, that it built to make analog and embedded processing chips in four fabs.9 The plant will begin production in 2025. TI also announced another 300 mm fab in Lehi, Utah, that will produce chips by 2026.10 The fab will cost $11 billion and will create 800 jobs.

Of course, not all semiconductor makers are on the bandwagon of building fabs. In some cases, it has come to a buy decision. For example, Bosch announced last month its intention to buy the assets of TSI Semiconductors based in Roseville, CA. Over the next five years, the company will invest about $1.5 billion to make it a state-of-the-art fab. By 2026 it will produce 200 mm silicon carbide (SiC) wafers.

Clearly, semiconductor manufacturers are planning on investing in the future, and part of that plan includes robust semiconductor manufacturing in the United States. We’ve heard about Silicon Valley for a long time, but the landscape is expanding. The Silicon Gulch of Texas, the Silicon Desert of Arizona, the Silicon Alley of New York, and the Silicon Mesa of New Mexico are taking their place on the semiconductor map. In the next decade, a focus on components should place the United States in a leadership position when it comes to electronics manufacturing.

References:

Have questions or comments? Continue the conversation on TechForum, DigiKey's online community and technical resource.

Visit TechForum