Uncertain Times Call for Careful BOM and Vendor Management

To call the current electronics manufacturing and sourcing landscape dynamic would be an understatement. Much cannot be controlled, so the only option is to mitigate and manage. Leveraging innovative technologies can help, but building strong distribution partnerships is critical. With a distributor, OEMs can maximize the impact of bill of materials (BOM) and vendor management.

Risk reduction genius

Effective BOM and vendor management are central to minimizing risk in the current tumultuous market. A well-managed BOM that lists every component, its specifications, and approved suppliers helps identify supply chain vulnerabilities such as parts that are single-sourced or have long lead times.1

Knowledge is power. Working with a distributor, these data points indicate where qualifying alternate sources are essential or where pre-ordering critical components is prudent. Such knowledge may also create an opportunity to redesign early to avoid parts bottlenecks.

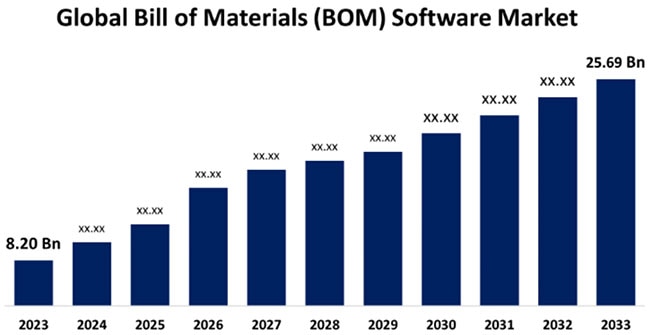

The improvement in tools for BOM management has increased the impact these activities can have. Such tools allow for BOM creation, management, and sharing, reducing errors and improving efficiency throughout the process. They can also identify components that are approaching end-of-life. As we know too well, electronic system designs are increasingly complex, creating enormous amounts of data that need to be accurate and available promptly. This has led to the electronics industry holding the largest share of the BOM software market that Spherical Insights projects to grow at a CAGR of 12.10% from $8.20 billion in 2023 to $25.69 billion by 2033 (Figure 1).2

Figure 1 : The global BOM software market size is projected to grow at a CAGR of 12.10% from $8.20 billion in 2023 to $25.69 billion by 2033. (Image source: Spherical Insights)

Figure 1 : The global BOM software market size is projected to grow at a CAGR of 12.10% from $8.20 billion in 2023 to $25.69 billion by 2033. (Image source: Spherical Insights)

When used effectively, this software allows collaboration with distribution partners to streamline production and inventory planning in real-time.

Risky relationships

Managing parts and materials is only half the battle. Together, OEMs and distributors also need to focus on vendor management, now more than ever. Strong vendor management systemically monitors and evaluates existing vendors and other potential partners in various areas, including financial stability, regulatory compliance, cybersecurity, and performance. Ongoing monitoring and auditing quickly detect issues for treatment and help spot looming regulatory or compliance problems early.

Technology has raised the bar on vendor management by monitoring key metrics, including return on investment (ROI), risk assessment, pricing and competitiveness, compliance, service quality, and innovation. Effective vendor management includes contingency planning, such as maintaining backup suppliers and alternative sourcing strategies to respond to disruptions quickly. Automated vendor onboarding, performance tracking, and analytics streamline procurement processes, reduce human error, and provide actionable insights for mitigating emerging risks.

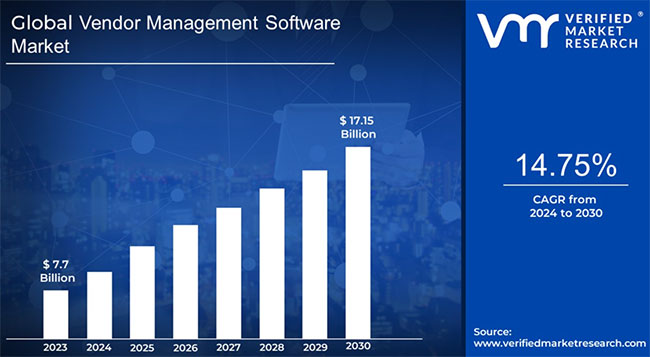

Vendor management software helps address the complexity and rapid evolution of supplier relationships. Strong growth in the sector underscores this trend. The market was valued at $7.70 billion in 2023 and is projected to reach $17.15 billion by 2030, reflecting a CAGR of 14.75% (Figure 2).3

Figure 2 : The global vendor management software market was valued at $7.70 billion in 2023 and is projected to reach $17.15 billion by 2030, reflecting a CAGR of 14.75%. (Image source: Verified Market Research)

Figure 2 : The global vendor management software market was valued at $7.70 billion in 2023 and is projected to reach $17.15 billion by 2030, reflecting a CAGR of 14.75%. (Image source: Verified Market Research)

Partner practices

Technology, however, isn’t a global panacea for navigating the fast-changing market realities. Historically, procurement has developed strategic alliances built on trust, shared objectives, and open communication. Stress and panic, though, can push organizations toward a more transactional approach to get the parts they need. Buying from an unknown supplier to get a good deal or quick delivery is a risky venture.4 A strong distributor partnership supports efficiency and innovation.

With their broad and deep relationships with component makers, distributors can analyze customers’ needs, product knowledge, and sales capabilities when judging potential vendors. They have their fingers on the pulse of technical expertise and product roadmaps. By engaging in joint planning and forecasting with their vendors, distributors can anticipate demand more accurately and help mitigate risk. On the component side, a thorough understanding of device specs, quality standards, and vendor offerings supports risk-tolerant sourcing from design to manufacturing.

Software tools for managing BOM and vendors are evolving quickly to support the complexity of manufacturing with advanced electronic devices. However, the old-school approach to distribution relationships will continue to serve us well, even as we leverage these new tools as part of a robust strategy to get ahead in turbulent times.

References

1: https://www.getamplio.com/post/bill-of-material-bom-101

3: https://www.verifiedmarketresearch.com/product/vendor-management-software-market/

4: http://sourceday.com/blog/mastering-vendor-risk-assessments-a-guide-for-manufacturing-leaders/

Have questions or comments? Continue the conversation on TechForum, DigiKey's online community and technical resource.

Visit TechForum