The U.S. Progresses in Bid for Semiconductor Manufacturing Superiority

The United States (U.S.) has been pushing to capture a stronger position in the worldwide semiconductor manufacturing industry for several years. While measurable progress is being made, as with any enterprising plan, it takes longer than expected.

The CHIPS and Science Act was signed into law in August 2022, making up to $52 billion in funding available to incentivize semiconductor makers to establish new manufacturing operations in the U.S.[1] Between 2022 and 2032, fab capacity in the Americas is expected to grow by 203%.[2] This will translate into slow and steady growth for the U.S. in terms of semiconductor market share, from 10% in 2012 to 14% by 2032. However, without the support of the government program, the U.S. market share would likely have slipped to just 8%, pundits say.

New builds abound

Of course, even as the U.S. doubles down on fab capacity, other countries are scrambling to put a stake in the ground. According to SEMI's latest quarterly World Fab Forecast report, the semiconductor industry will likely start 18 new fab construction projects in 2025.3 The new projects, which include three 200 millimeter (mm) and fifteen 300 mm facilities, will begin operations in 2026 and 2027.

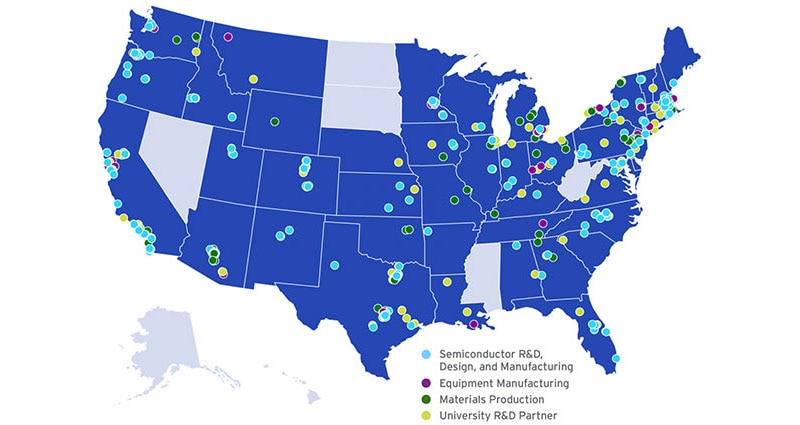

The Americas (primarily the U.S.) and Japan lead the charge in building semiconductor fabs, with four each on the books out of the 18 that are planned (Figure 1). However, the Europe & Middle East and China regions are close behind with three each.

![]() Figure 1: The U.S. and Japan lead the charge in building semiconductor fabs, with four each on the books out of the 18 that are planned. However, Europe/Middle East and China are close behind with three each. (Image source: SEMI)

Figure 1: The U.S. and Japan lead the charge in building semiconductor fabs, with four each on the books out of the 18 that are planned. However, Europe/Middle East and China are close behind with three each. (Image source: SEMI)

Building a new semiconductor fab requires enormous investment, anywhere from $4 billion to $20 billion, and there’s no fast path to getting these plants online. Numerous factors affect costs, including the type of clean rooms, equipment, fluid management systems, manufacturing processes, and facility size.

These various investments are driving both cutting-edge and mainstream technologies. Generative AI (GenAI) and high-performance computing (HPC) rely on the newest logic and memory technologies. Meanwhile, various markets, including automotive and the Internet of Things (IoT), need large numbers of mainstream chips.

To secure ample supply, fabs are popping up all over. The SEMI report shows that the global semiconductor industry plans to begin operation of 97 new high-volume fabs over the next two years, including 48 projects launched in 2024 and 32 projects set to launch in 2025. These include manufacturing capabilities with wafer sizes ranging from 300 mm to 50 mm.

Underscoring the need for fabs, semiconductor sales are bumping up. In November, semiconductor sales hit $57.8 billion, up 20.7% over November 2023’s $47.9 billion (Figure 2).4 This represents the highest-ever monthly sales and comes after increases in month-to-month sales for 18 straight months, according to the World Semiconductor Trade Statistics (WSTS) organization.4 The Americas are enjoying better results than any other region. Year-to-year sales were up in the Americas by 54.9%, while other regions saw less growth: China at 12.1%, Asia Pacific/All Other at 10.0%, Japan at 7.4%, and Europe at -5.7%.

![]() Figure 2: Global semiconductor sales hit $57.8 billion in November 2024, an increase of 20.7% compared to the November 2023 total of $47.9 billion. (Image source: WSTS)

Figure 2: Global semiconductor sales hit $57.8 billion in November 2024, an increase of 20.7% compared to the November 2023 total of $47.9 billion. (Image source: WSTS)

The rule of renovation

All these signs point in a positive direction, but experience tells me it will take longer than many think. Looking at any complex project, from renovating a kitchen to building a company, that’s just the way things go. The situation in the semiconductor industry is exacerbated by geopolitical complexity, and that’s not going to change any time soon.

Here’s one proof point: In 2023, Taiwan Semiconductor Manufacturing Company (TSMC) anticipated opening its new factory in Arizona in 2024. Turns out it won’t happen until later this year. The laundry list of reasons was extensive: complex compliance requirements, local construction regulations, extensive permitting processes, supply chain disruptions, a lack of established regulations for chip plant construction in the U.S., and high chemical costs in the U.S.5

Similarly, Intel, which broke ground in 2022 in New Albany, Ohio, with an eye toward being operational this year, has said it won’t be able to open its doors until 2027 or 2028. In some reports, Intel pointed to market challenges and a slow rollout of U.S. government grant money. They also said the original timeline was three to five years, so they are within the window.

We want to be optimistic, but we also need to be realistic. Not only is building a semiconductor fab complicated, but the business landscape is unpredictable. The U.S. is moving ahead in building semiconductor infrastructure domestically, but it will take time.

References

1: https://www.meritalk.com/articles/into-2025-chips-and-science-act-investments-year-in-review/

4: https://www.semiconductors.org/global-semiconductor-sales-increase-20-7-year-to-year-in-november/

5: https://www.cio.com/article/3806430/delays-in-tsmcs-arizona-plant-spark-supply-chain-worries.html

Have questions or comments? Continue the conversation on TechForum, DigiKey's online community and technical resource.

Visit TechForum