Supply Chain Focus Shifts to Node Size Sourcing

The supply chain landscape is becoming more complicated, and OEMs need to apply their sourcing smarts to ensure they have chips at the required process node. The combination of new semiconductor fabrication plants (fabs) and advanced technologies creates fluctuations in supply and demand across geographies and process nodes.

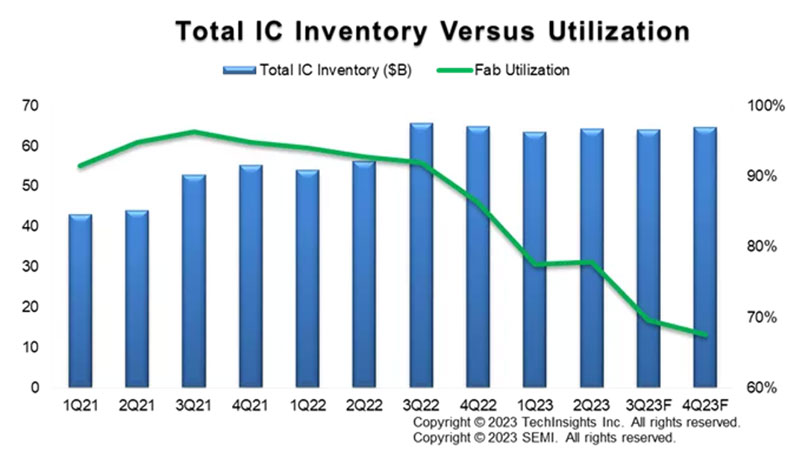

Some market realities are reassuring. Since the middle of 2022, semiconductor availability has outstripped demand at an increasing rate. In the second quarter of 2022, fab utilization rates were about 90%. However, that figure dropped to under 70% in the third quarter of 2023, according to a recent Semiconductor Manufacturing Monitor Report from SEMI1 (Figure 1).

Figure 1: Shown is a comparison of semiconductor inventory versus fab utilization; utilization dropped precipitously from 90% in Q2 2022 to under 70% in Q3 2023. (Image source: SEMI)

Figure 1: Shown is a comparison of semiconductor inventory versus fab utilization; utilization dropped precipitously from 90% in Q2 2022 to under 70% in Q3 2023. (Image source: SEMI)

Meanwhile, new fabs are popping up worldwide. The United States aims to increase its domestic semiconductor capacity share from 11% in 2020 to 30% in 2030. Similarly, Europe aims to more than double its share, from 9% to 20%.2 In the United States, chipmakers are likely to strive for greater self-sufficiency by investing in both advanced and trailing-edge nodes, as well as specialized chips.

Researchers anticipate that the semiconductor market will continue to experience steady growth, increasing from $20.18 billion in 2022 to $35 billion by 2032, representing a CAGR of 5.71% (Figure 2).3 According to Precedence Research, these shifts can be traced to improvements in semiconductor technology, including the transition to finer process nodes.

Figure 2: The semiconductor wafer market size was valued at $20.18 billion in 2022 and is expected to hit $35.16 billion by 2032. (Image source: Precedence Research)

Figure 2: The semiconductor wafer market size was valued at $20.18 billion in 2022 and is expected to hit $35.16 billion by 2032. (Image source: Precedence Research)

Change happens

The surging demand for electric vehicles (EVs), 5G, artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) will continue. Datacenter and cloud computing applications need chips that are powerful and energy efficient. At the same time, defense, medical, and other industries need durable technologies with long-term support. Legacy components used for low-power process technology, LCD drivers, and automotive will, in all likelihood, be increasingly scarce.

The diversity of applications brings with it a variety of technology requirements. At this time, semiconductor makers are working with four categories of node sizes: <11 nanometers (nm), 11 to 19 nm, 20 to 64 nm, and ≥65 nm. In addition to product lifecycle, some OEMs need zero-defect reliability and wider operating temperatures.4

The strategic question is whether or not semiconductor makers will get the product mix right, ensuring that the OEMs get what they need. Their decisions are guided by a blend of art and science and will determine availability, price, and lead times for OEMs.

Good practice

As shifting nodes create ebbs and flows in the supply chain, OEMs should focus on procurement best practices to prevent problems. These practices include:

- Review the supplier network regularly. By looking far and near for supply sources, supply chain pros will have more options when shortages occur.

- React fast. When a disruption occurs, OEMs need to react fast. Supply chain technologies that increase resilience and transparency will become more critical, as will advanced analytics and forecasting.

- Plan purchases carefully. By working closely with distribution partners, OEMs can plan for and purchase extra inventory early. This practice can get pricey, but it's worth it for critical, high-risk components.

Always a bit chaotic, the semiconductor market will become more unpredictable as IC process node availability becomes uncertain, even as new foundries come online. To navigate the shifting landscape, OEMs must get back to basics and plan carefully to get the needed parts.

References

3: https://www.precedenceresearch.com/semiconductor-wafer-market

Have questions or comments? Continue the conversation on TechForum, DigiKey's online community and technical resource.

Visit TechForum