Start Planning Now: Global MLCC Uncertainty to Plague Electronics Industry for Foreseeable Future

The multilayer ceramic capacitor (MLCC) industry has been haunted by shortages and long lead times for years. The bad news is that it’s likely that this inexpensive mainstay of electronics design will continue to cause industry headaches well into the future. Start planning for it now.

How big of a headache will MLCCs become?

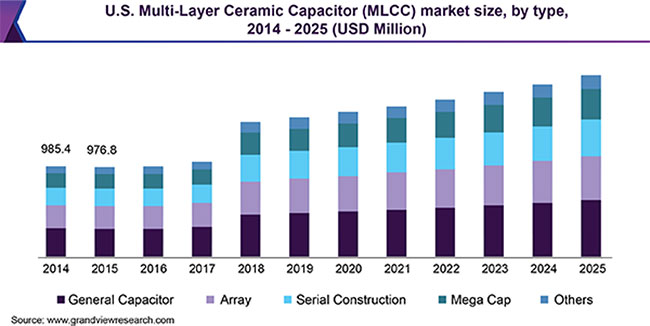

MLCCs are clearly a mainstay of the electronics industry, representing a robust opportunity for component makers. In a recent report, Grandview Research1 valued the US MLCC market at $8.75 billion in 2018 and projected a compound annual growth rate of 5.1% over the next five years (Figure 1).

Figure 1: The capacitor industry has enjoyed slow and steady growth but in the next few years the bump up will be notable, analysts believe. (Image source: Grandview Research)

Figure 1: The capacitor industry has enjoyed slow and steady growth but in the next few years the bump up will be notable, analysts believe. (Image source: Grandview Research)

“MLCCs are also integrated into smart LCD and LED televisions,” Grandview reported. “The increasing popularity of such televisions is expected to accelerate market growth. Moreover, the emergence of the Internet of Things (IoT) is creating diverse opportunities for the market as MLCCs are an ideal solution for IoT devices owing to their long service life and intrinsic reliability.“

These surface mount devices (SMDs), made by alternating layers of ceramic and metal, are available from several companies in a wide range of capacitance values and are used in a broadening range of end-use industries. For example, the CC Series Class 2 X5R from YAGEO is one of a large selection of MLCCs from the company (Figure 2). The 22 microfarad (µF) capacitor (±20%) comes in an 0603 package and is rated for 4 volts to 50 volts. It is aimed at general applications, including PCs, hard disks, power supplies, mobile phones, and data processing.

Figure 2: YAGEO’s X5R series chip capacitors with lead-free terminations feature nickel-barrier and termination and are RoHS compliant. (Image source: YAGEO)

Figure 2: YAGEO’s X5R series chip capacitors with lead-free terminations feature nickel-barrier and termination and are RoHS compliant. (Image source: YAGEO)

The ubiquitous nature of the component has become a bit of a stumbling block as diverse industries, including automotive, consumer electronics (such as digital cameras and PC servers), data processing, and telecommunications vie for available stock.

The search for MLCC capacity

A combination of traditional and emerging applications will drive demand in the coming year—and will likely result in rising prices and lengthening lead times.

Further, increased demand can be traced to overreactions during the pandemic and in response to long lead times in 2019. Some OEMs have been stockpiling products, tightening supply, and skewing demand patterns.

In addition, raw metal prices are souring on some key metals. Palladium prices, a primary electrode material in MLCCs that need high-reliability, high-temp, and high voltage ratings, have been trending up consistently reaching a 25-year high in January 2020.2 Independent analyst Metals Focus predicts that palladium prices, which demanded a price tag of $2,900 per ounce in 2019, will bump up against $3,000 an ounce in 2021.3 The decade-long supply deficit is likely to continue, they added. Nickel, another metal used in MLCC electrodes, has reached a ten-year pricing high, going from $10,800 per ton in March 2020 to $18,244 per ton in just ten months, an increase of 70%, according to Forbes.4

At an industry level, there are indications that demand will outstrip capacity in the coming year. Global passive component output is expected to grow by 11.1%, but demand will grow by 15%, according to a report in SemiMedia.5 However, that’s an average. In some industries, demand growth will be significant. Automotive electronic component buys, for example, will likely explode 35% to 50%, with passive components including MLCCs and resistors representing a lion’s share of the demand. Analysts predict that this may also help drive prices up in the latter half of 2021.

Conclusion

MLCCs are hitting roadblocks at every level: from raw materials pricing to capacity capabilities on the part of component makers. At that same time, emerging applications are likely to keep MLCC demand on the rise for years to come. MLCCs can no longer be considered a generic component buy. With shortages likely to continue, it’s advisable for OEMs to create strategic plans and partnerships to ensure that a component that costs a few pennies doesn’t halt production on a critical end product.

References:

1 – https://www.grandviewresearch.com/industry-analysis/multi-layer-ceramic-capacitor-mlcc-market

Have questions or comments? Continue the conversation on TechForum, DigiKey's online community and technical resource.

Visit TechForum