Shifting Semiconductor Sources Demand Procurement Smarts

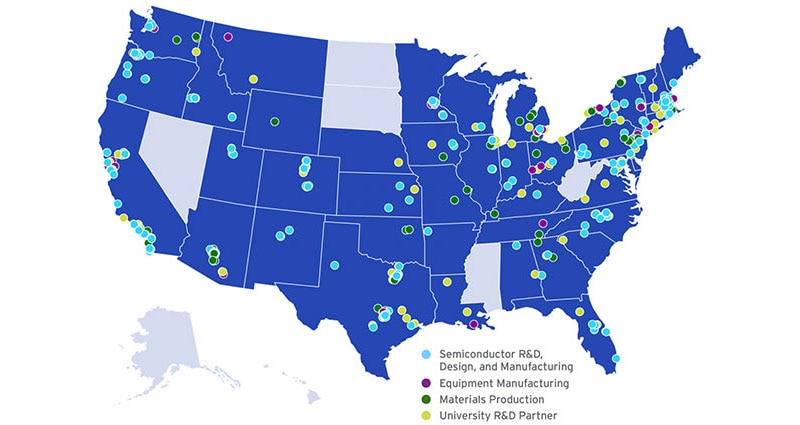

As insiders, we know that semiconductors are the linchpin of the modern world, from their prominent role in computers, smartphones, and now automotive, to more discrete ambient sensing applications where their presence is barely noticeable. The increasing awareness of their importance and the danger of a single source to supply chain security has resulted in sophisticated semiconductor manufacturing plants in new locations from the United States (US) and Europe to India, Vietnam, and Thailand.

Meanwhile, the US Department of Commerce issued a ruling to guard China and other countries deemed threatening to national security from benefiting through US funding.1 It’s too early to know the impact, but it certainly will be a factor in sourcing decisions.

Considering the shifting manufacturing landscape, OEMs must closely monitor their supply chain to safeguard their procurement plans from vulnerabilities and ensure the resiliency and diversity that keep products on the manufacturing line.

Room to grow

According to market research pundits, the global semiconductor market is set for solid growth over the next decade. Precedence Research puts the global semiconductor market at $591.8 billion in 2022, a figure that will grow to $1,883.7 billion by 2032 (Figure 1).2 Network and communications accounted for about a third of the market in 2022, while data processing accounted for 30% of market share.

Growth can be traced to the increasing adoption of consumer electronics worldwide, as well as growth in sales for artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), and wireless communications devices. Strong governmental support meant to attract semiconductor manufacturers in the US, Canada, India, and other regions is also a contributor.

![]() Figure 1 : The global semiconductor market will increase steadily at a compound annual growth of just over 12 percent per year over the next decade. (Image source: Precedence Research)

Figure 1 : The global semiconductor market will increase steadily at a compound annual growth of just over 12 percent per year over the next decade. (Image source: Precedence Research)

Nailing down stability

In recent years, various factors shone a light on the relative frailty of the semiconductor supply chain. Planning for disruption, or at least the possibility thereof, may be the new normal.

The supply chain for semiconductors is sophisticated and complicated, translating into shifting supply and demand created by the decisions made by semiconductor manufacturers. Business consulting firm EY outlines the various stages of semiconductor manufacture, all of which can impact buyers:3

1: Design: Designers implement functions and performance specs in the semiconductors.

2: Manufacture: The manufacture of semiconductor raw materials and components, including wafers, masks, and packages. The process includes forming circuits on the wafer and wafer dicing, packaging, and testing.

3: Sale: Offering semiconductor products and services.

4: Final product: Using the manufacturer's semiconductor in various end products.

The complexity comes because the semiconductor value chain is often spread across the globe: with design in one country, the manufacturing of silicon in a second location, and back-end processes taking place in a third location. Modern manufacturing facilities in new places require learning another landscape. For example, the regulations around materials may be different. Tariffs and taxes will shift depending on where inventory is located and how supply and demand evolve. At least in the early stages, the recruitment pool may require more skills or knowledge, resulting in talent shortages.

Chip manufacturers are faced with making choices that result in the right mix of products to maximize business outcomes. New efforts often focus on the latest technologies, from the smallest wafers to the most advanced chip packages. This presents challenges for customers requiring older technology at legacy nodes, or those who need high-reliability chips at low volume. Customers who need chips with custom specifications will also be challenged because it’s difficult to balance customization with the need for multiple sources or easy redesigns that make the supply chain flexible.

Developing hot spots

The next several years will also open new sources of potential supply. At the same time, the push toward the latest technologies may result in shortages of more mainstream products.

Earlier this year, the United States, Mexico, and Canada announced that the three countries would organize “the first-ever trilateral semiconductor forum with industry to adapt government policies and increase investment in semiconductor supply chains across North America.”4 Meanwhile, Indonesia and the Philippines are inviting investments from the semiconductor industry as part of the Indo-Pacific Economic Framework for Prosperity (IPEF).5 And, of course, traditional leaders, including China and Malaysia, will continue to actively court investments.

Sourcing organizations must work closely with distribution and supply partners to ensure the availability of mainstream and long-lived products while considering emerging locations for the newest tech.

It will take time for new sources of supply to get up and running. However, in five years, the landscape of semiconductor manufacturing promises to look exceedingly different. Innovative organizations will continue to scrutinize their semiconductor supply chain to mitigate risk and maximize the potential of these new sources. It’s clear that the semiconductor manufacturing market will be in flux for some time to come.

References:

Have questions or comments? Continue the conversation on TechForum, DigiKey's online community and technical resource.

Visit TechForum