ESG Initiatives Drive Finances—And Get Attention

In the electronics supply chain, risk comes from many directions. Increasingly, environment, social, and governance (ESG) practices are being leveraged as a way to measure potential risk by OEMs and their vendors. This is part of the natural progression that procurement has been taking away from focus on transactional relationships and reducing prices as a primary goal to a more holistic approach that recognizes that a long-term strategy nets better and more sustainable results.

The list of reasons that we have come to this is long. Consumers are increasingly looking for strong ESG credentials; new and stringent regulations are being implemented in many industries; and investors, employees, and prospective talent are increasingly using ESG as a measure of organizational quality. The trend is supported by research that shows organizations that perform well in terms of ESG enjoy faster financial growth and higher valuations.

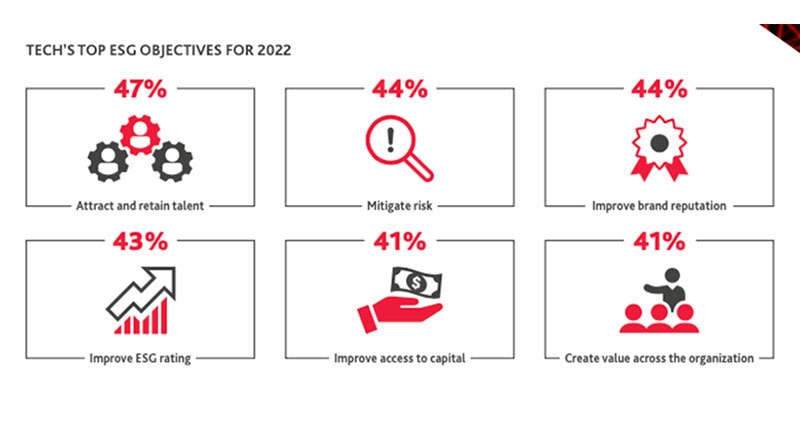

In the 2022 BDO Technology CFO Outlook Survey1, for example, 69 percent of CFOs surveyed believed that implementing an ESG program would positively impact their company’s long-term financial performance. And 23 percent said that meeting ESG goals would be a top supply chain priority for 2022, making it the most popular answer, outstripping cost reduction, capital efficiency, and others.

Figure 1: The CFOs of nearly half of the technology companies surveyed report that they are increasing investment in ESG. The goals of these ESG programs vary—but many see their investment as an opportunity to address major business challenges, ranging from human resources to finances. (Image source: 2022 BDO Technology CFO Outlook Survey)

Figure 1: The CFOs of nearly half of the technology companies surveyed report that they are increasing investment in ESG. The goals of these ESG programs vary—but many see their investment as an opportunity to address major business challenges, ranging from human resources to finances. (Image source: 2022 BDO Technology CFO Outlook Survey)

It’s in the Ether

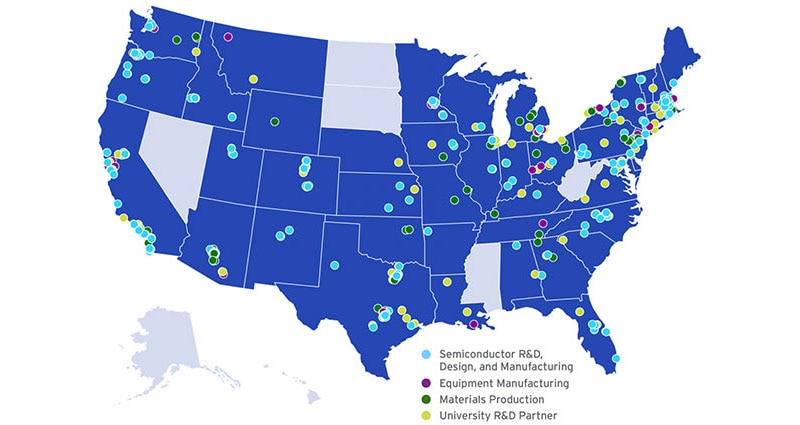

Particularly in the electronics industry, I’m seeing signs of this new direction. The IPC, an electronics trade organization, for example, announced its ESG for Electronics Initiative last year.2 It promised to “develop guidance for electronics manufacturers on an industry-specific approach to ESG practices and reporting, and to develop aspirational goals that the industry is working together to achieve.”

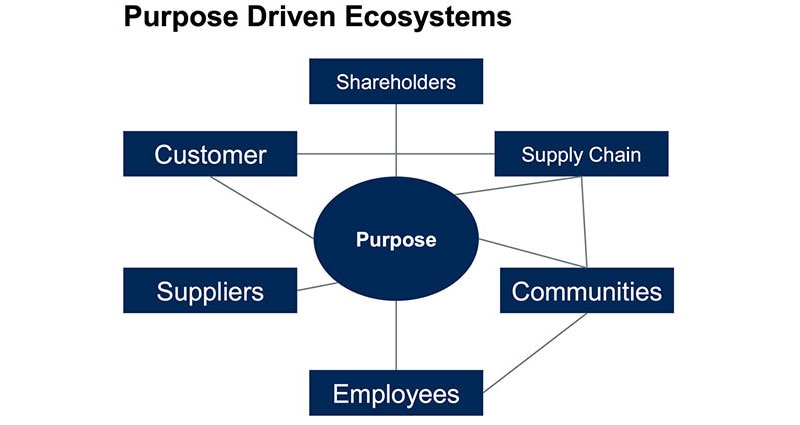

The group laid out some of the areas that ESG touches, including:

- Environmental: Greenhouse gases, renewable energy, water management, waste management, energy management in manufacturing, landfill diversion, new headquarters building, product energy efficiency, and materials sourcing.

- Social: Employee health and safety, human rights, community, product lifecycle management, workforce diversity goals, employee development, fair wages and benefits, and collective bargaining.

- Governance: Gender composition on boards, executive pay linked to sustainability issues and/or diversity, shareholder meetings, directors having risk management expertise, supply chain integrity, ethics, and compliance.

With materials sourcing, product life cycle management, collective bargaining, supply chain integrity, ethics, and compliance are all front and center on the list. The only way for ESG initiates to succeed is for the supply chain and procurement practices to be carefully planned and executed.

Not quite ready

It’s clear that procurement, which is the primary interface to the upstream supply chain, has an important role to play in ESG initiatives. Most, however, report that they don’t feel up to the job, due to a lack of tools, skills, and data, according to a recent study from McKinsey. Procurement organizations can build this capacity. The good news is that making real strides takes months, not years. McKinsey outlines a three-step process to integrate ESG into the business by developing ESG-focused data, processes, and capabilities.

1: Determine the baseline and how far to go. Start by trying to understand where the organization is today in terms of ESG. Look for gaps that create risk and areas that can be readily improved. Think about these possibilities in light of the organization’s overall ESG agenda—then set measurable goals and targets for sustainable procurement.

2: Establish the core and drive value-creation initiatives. Define ESG metrics and policies and integrate those into the organization’s supplier selection, procurement, and supply management processes. At the same time, choose some top-priority ESG themes and work on them through cross-functional initiatives aimed at driving both innovation and improvement.

3: Shift the organization. Scale-up and roll out successful initiatives. Once sustainable purchasing practices are solidly understood and implemented in the supply chain, embed them across the overall organization. Procurement folks should be trained regularly about sustainable procurement principles and applications. Track performance against the stated goals because what we measure is what ends up mattering—and getting done.

Figure 2: Pushing ESG to the top of the procurement agenda doesn’t need to take years. Instead, sustainable procurement is a matter of creating a vision, implementing the strategy, and continuing to measure the results. (Image source: McKinsey)

Figure 2: Pushing ESG to the top of the procurement agenda doesn’t need to take years. Instead, sustainable procurement is a matter of creating a vision, implementing the strategy, and continuing to measure the results. (Image source: McKinsey)

Truly, ESG is a business approach and an attitude rather than some predefined set of procurement and supply chain tools. Whereas before, ESG performance was primarily a concern for large public companies, it is now something that every organization at every level of the value chain, from OEMs down to lower-tier suppliers, needs to be thinking about. Increasingly, stakeholders, from investors to employees to customers, are demanding a good ESG report card as a sign that an organization is being thoughtful in managing risk.

References:

1: https://www.bdo.com/insights/industries/technology/cfo-survey-technology

2: https://www.ipc.org/esg-electronicshttps://www.ipc.org/esg-electronics

Have questions or comments? Continue the conversation on TechForum, DigiKey's online community and technical resource.

Visit TechForum