Chip Fabs Expand the Vision of Asia Chip Manufacturing

For decades, heated competition has existed for a bigger slice of the worldwide semiconductor pie. Even as Europe and the United States are trying to claw their way back to the leadership position they once enjoyed, Taiwan is working to maintain its current leadership, and Asian countries like India, Thailand, and Vietnam are trying to carve out their own toeholds. Now, as the United States wrestles with its relationship with China, these Southeast Asian countries have an opportunity to enter the market.

The upside of such a move is substantial. The Asia-Pacific semiconductor market is currently worth $430.24 billion and will likely balloon to $695.73 billion over the next five years, according to Mordor Intelligence.1 In the region, growth is predicted to be strong year over year, reaching more than eight percent annually.

The might of Taiwan

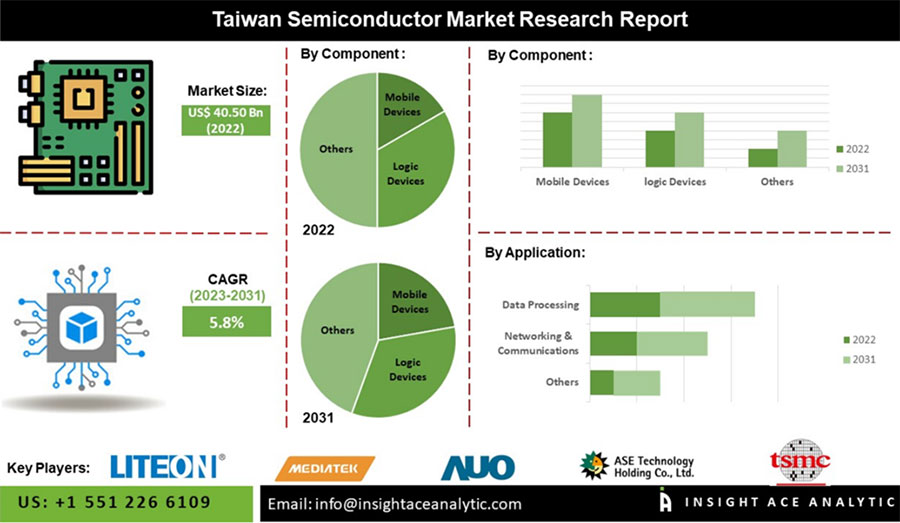

The Taiwan semiconductor market accounted for $44.5 billion in sales in 2022 and is estimated to reach over $66.06 billion by 2031, according to market research firm Insight Ace Analytic.2 That growth will likely be driven by a handful of emerging applications, including the Artificial Intelligence (AI) of Things (AIoT), 5G, and high-performance computing. The country continues to invest in advanced technology and increased production capacity. Several recent highlights include:

- December 2022: Taiwan Semiconductor Manufacturing Co. (TSMC) celebrated its entrance into volume production at the 3 nanometer (nm) node at its Fab 18 Phase 8 facility in Taiwan. TSMC estimates that 3 nm technology will create end products with a market value of $1.5 trillion within five years of volume production.3

- June 2023: TSMC and Purdue University's Center for Secure Microelectronics Ecosystem renewed a partnership through 2031 and will work toward increasing the trained semiconductor workforce and other study projects. The partnership began in 2021 and was the first of its kind to link the university, industry, TSMC, and the government.

- July 2023: TSMC announced plans to invest $2.9 billion to build an advanced chip plant in Taiwan to meet strong demand for AI products. The global research and development center is located in Hsinchu, Taiwan, and employs 7,000 people.4

Figure 1 : Taiwan semiconductor makers are pushing the technology envelope and eyeing leading-edge process technology at 2 nm and beyond. (Image source: Insight Ace Analytic)

Figure 1 : Taiwan semiconductor makers are pushing the technology envelope and eyeing leading-edge process technology at 2 nm and beyond. (Image source: Insight Ace Analytic)

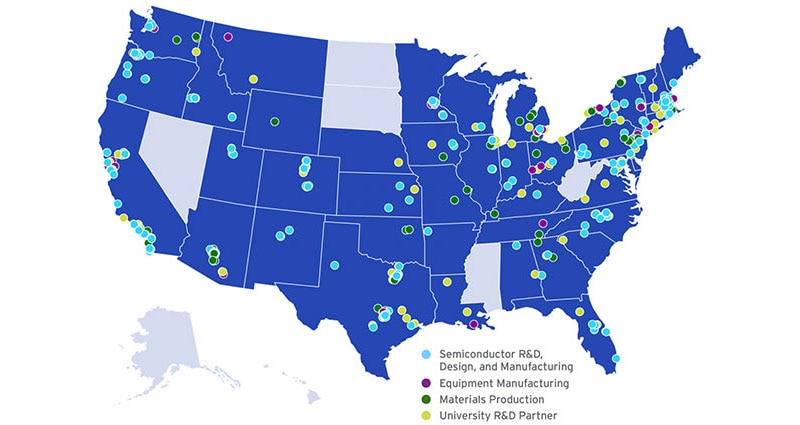

Newer pastures

While Europe and the United States want to create more semiconductor capacity domestically, the trend toward more geographically dispersed semiconductor manufacturing will likely continue (Figure 2). Taiwan, South Korea, and China continue ramping up, and new foundries are beginning to emerge in other regions across Asia. These newer semiconductor pastures include India, Thailand, and Vietnam.

Figure 2 : Europe, the U.S., and Japan dominated semiconductor manufacturing in 1990. Then South Korea, Taiwan, and Mainland China entered the market, leaving the original big three locations with a combined market share of about 35% in 2020. (Image source: Statistica)

Figure 2 : Europe, the U.S., and Japan dominated semiconductor manufacturing in 1990. Then South Korea, Taiwan, and Mainland China entered the market, leaving the original big three locations with a combined market share of about 35% in 2020. (Image source: Statistica)

India, which until now has had no traction in the semiconductor manufacturing industry, has some nascent efforts afoot, but progress has been slow. For example, Vedanta-Foxconn Semiconductors, a joint venture between India’s Vedanta group and Taiwanese contract manufacturer Foxconn, hoped to start generating revenue from a semiconductor fab in India by 2027. Construction on the plant was planned for the end of the current fiscal year.5 The joint venture was seeking $20 million in government funds for the project. The fab would have focused on 40 and 28 nm nodes to supply the automotive industry, but Foxconn pulled out of the deal.

However, momentum will likely resume. India’s government has approved a $9.14 billion program to support the manufacture of semiconductors and displays in India. Also, several American semiconductor companies are considering a presence in India. In June, Micron Technology announced that it would begin construction of a fab in the Indian state of Gujarat and expects Phase 1 to be up and running in late 2024.6 Meanwhile, Foxconn may ink a deal with chipmaking equipment Applied Materials to manufacture in the state of Karnataka.

Thailand is also bidding to provide a home to semiconductor fabs using corporate tax breaks. In the past, Thailand offered tax relief for up to eight years, but now the country exempts corporations for up to 13 years. The hope is to attract companies focused on more sophisticated front-end processes, such as designing chips and etching wafers. Like India, Thailand’s efforts are more hope than reality, though various organizations continue holding discussions.

Another up-and-coming location for chip makers is Vietnam, which is also investing to attract new business. The country is enticing because of its proximity to China, its existing robust port system, and the presence of low-cost skilled labor.7 The efforts appear to be paying off as Samsung Electronics will invest an additional $3.3 billion in the region. The company has spent $65 billion there since 2021 and now has a total of 28 factories in the region.

The semiconductor manufacturing landscape is shifting. While traditional players will jockey for position, the next decade will likely see more countries in Asia producing semiconductors, despite the technical challenges, creating a richer and more varied array of sources than ever.

References:

1: https://www.mordorintelligence.com/industry-reports/asia-pacific-semiconductor-device-market

3: https://pr.tsmc.com/english/news/2986

4: https://pr.tsmc.com/english/news/3044

7: https://www.vietnam-briefing.com/news/where-are-samsungs-factories-in-vietnam.html/

Have questions or comments? Continue the conversation on TechForum, DigiKey's online community and technical resource.

Visit TechForum